Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically lack collateral, steady employment, or a verifiable credit history. It is designed to support entrepreneurship and act as a tool to alleviate poverty.

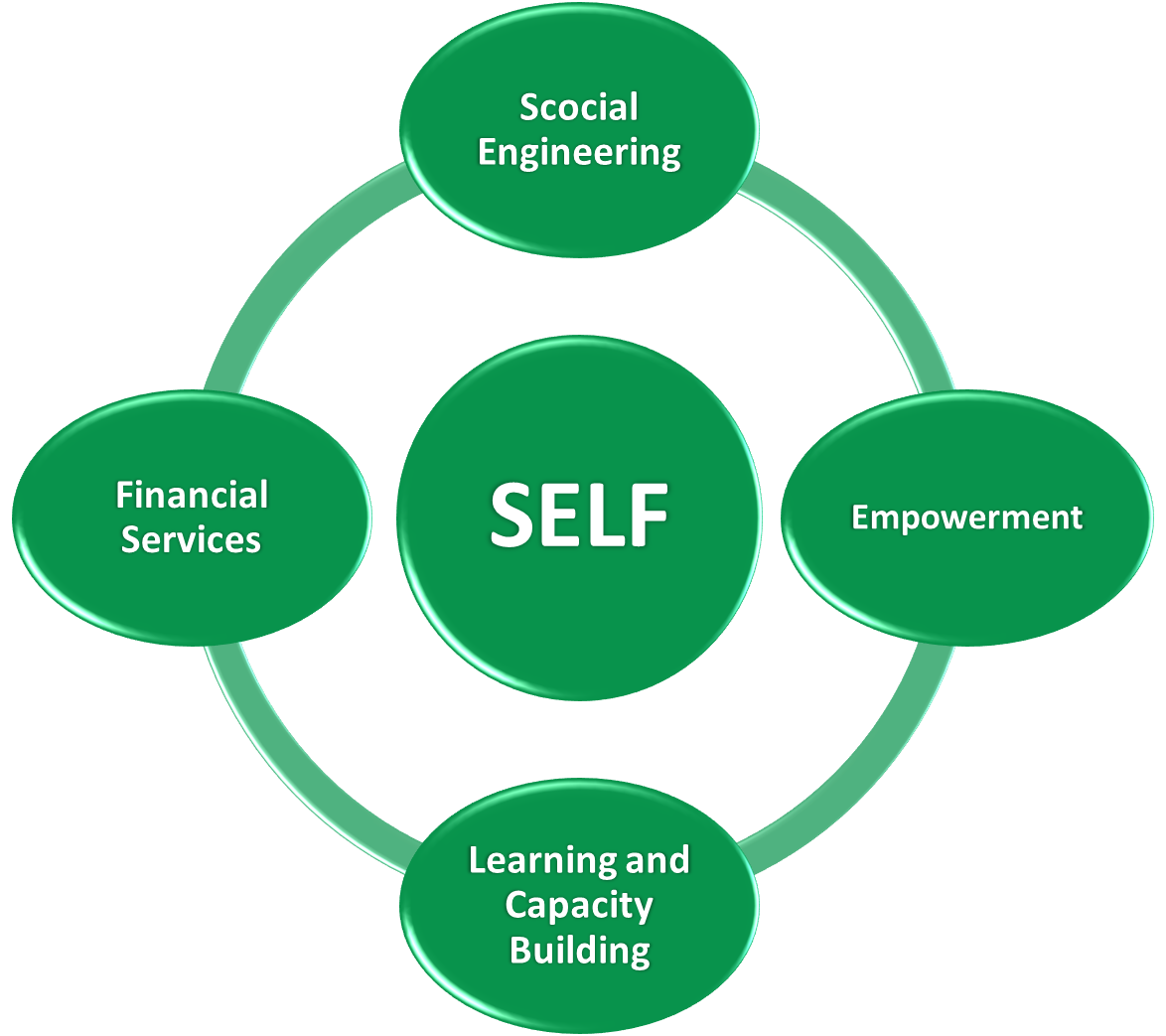

The microenterprise has proven to be the backbone of economy both at micro and macro level. SELF provides motivational, information as well as managerial inputs to SHGs and JLG’s for undertaking income generating activities and micro enterprises.

Sampada Entrepreneurship & Livelihoods Foundation acts as a Corporate Agency on behalf of two major insurance companies in order to provide “at-the doorstep” insurance services to women in remote rural areas. Risk coverage is provided by way of life as well as general insurance.

After the death of my wife, the Micro-insurance provided by Sampada Entrepreneurship & Livelihood Foundation (SELF) has ensured for Rs. 50000/- and we have invested this amount in the national saving certificate which will yield Rs. 106250/- after 15 years which will be useful for my son's education.

I had taken a personal accident insurance policy for my Husband ,Whom passed away in 2018. An accident insurance policy claim in his name has been approved by the Insurance Company and a cheque for Rs. 50,000/- has been received. This claim amount I used for my daughter's marriage.

91400001

968400000

50703

101406

Bankar Mala, Behind Tahsil Karyalaya

"Dnyaneshwari", Bhavaninagar

Bejgamwar House, Sant Gajanan Niwas, Anandnagar

Pravati Nagar, Vikram Sasane Mala, Behind Nirmay Hospital

Landewadi, Near Ugale Ladies Hostel

MuktAnuiyam Trimurti Colony -2 , Dattanager, Nawagan College Road

House No. 9, Samta Nagar, Vaijapur Road

Providing feasible livelihood alternatives.

Socializing likeminders.

Empowering with knowledge.